Blog

Recent Blogs

What Evidence to Collect After a Dog Attack

Inevitably, dog attacks can happen. We hope you never have to suffer through one, but if you do, it’s important to know what next steps to take.

Save Your Claim: Why You Should Have a Dash Cam in Your Vehicle

Proving fault in an auto accident can be a complex, and intricate process. But why not make sure you are covered in the case that someone else hits you? That’s where dash cams come in.

New Technology to Reduce Ohio Highway Crashes

Ohio Governor Mike DeWine and the Ohio Department of Transportation (ODOT) announced a new effort to help reduce and prevent the number of serious crashes

Car Accident Blogs

Save Your Claim: Why You Should Have a Dash Cam in Your Vehicle

Proving fault in an auto accident can be a complex, and intricate process. But why not make sure you are covered in the case that someone else hits you? That’s where dash cams come in.

New Technology to Reduce Ohio Highway Crashes

Ohio Governor Mike DeWine and the Ohio Department of Transportation (ODOT) announced a new effort to help reduce and prevent the number of serious crashes

Winter Weather and Car Accidents: What to Do if You’ve Been Injured

Winter weather can be unpredictable and dangerous, especially when it comes to driving. Snow, ice, and freezing temperatures can make roads slick and visibility difficult.

Personal Injury Blogs

Winter Weather and Car Accidents: What to Do if You’ve Been Injured

Winter weather can be unpredictable and dangerous, especially when it comes to driving. Snow, ice, and freezing temperatures can make roads slick and visibility difficult.

Debunking the Most Common Personal Injury Claim Myths

If you’re wondering whether filing your claim is worth it, then read on as we debunk the three most common myths from personal injury lawyers.

3 Ways to Improve Your Insurance Offer

Improve Your Insurance Offer https://youtu.be/_eRIa2vQRYg Let’s talk about property damage. As Cleveland Personal Injury Lawyers, we get questions about property damage all the time. We often

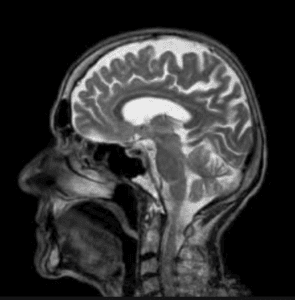

Traumatic Brain Injury Blogs

Navigating Support: Resources for Traumatic Brain Injury (TBI) Victims in Ohio

From understanding the nuances of TBIs, to harnessing community support and the latest in rehabilitative technology, Ohio’s expansive network of aid is ready to help those affected by TBIs.

DTI: An Important Tool for Diagnosing TBIs

DTI examines the microstructure of the brain, including white matter tracts, and can detect diffuse axonal injury, one of the most severe and under-diagnosed forms of brain damage.

What is the Average Settlement for a Traumatic Brain Injury?

Traumatic Brain Injury Settlements It’s unfortunate that head injuries are a common result of car accidents, medical malpractice, and other negligent acts. The US Centers for Disease

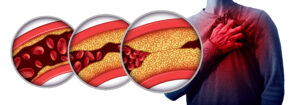

Medical Malpractice Blogs

Every Second Counts: The Importance of Timely Heart Attack Diagnosis

Heart attacks are a leading cause of death in Ohio, and every second you wait on a proper diagnosis, counts. Unfortunately, even with advanced medical technology, medical providers can and do fail to diagnose or misdiagnose heart attack symptoms.

Is Surgery More Dangerous Than We Think?

Surgical Specialties Resulting in Claims Of the surgery-related medical malpractice claims that were analyzed for this study, over 47% of them involved just three surgical

Do You Have a Valid Medical Malpractice Lawsuit?

Doctor’s Mistakes Can Create Valid Malpractice Lawsuits Doctors are human beings and make mistakes like anyone else, but when a mistake reflects a serious error

Nursing Home Abuse Blogs

Dropped Patients in Ohio Nursing Homes

Dropped patients in Ohio Nursing Homes can suffer catastrophic injuries.

What Nursing Homes are in Cuyahoga County?

View Tittle & Perlmuter’s map and list of nursing homes in Cuyahoga County.

Ways to Report Nursing Home Neglect in Ohio

How Do I Report Nursing Home Neglect in Ohio? Nursing homes and assisted living facilities exist to help and protect those who cannot fully care

Wage and Hour Blogs

Can Salaried Employees Receive Overtime Pay in Ohio?

Overtime Exemptions Did you know that not all salaried employees are exempt from overtime? This is a very common misconception that is simply not true.

Complaints Against Cuyahoga County for Illegal Pay Practice

Cuyahoga County Illegal Pay Practice When hourly Corrections Officers begin training at the Cuyahoga County Corrections Center, they are required to complete homework assignments during

New Ohio Legislation to Crack Down on Wage Theft

Ohio Cracking Down on Wage Theft According to Policy Matters Ohio, employers steal from more than 213,000 Ohioans each year by paying workers below the